44 coupon rate semi annual

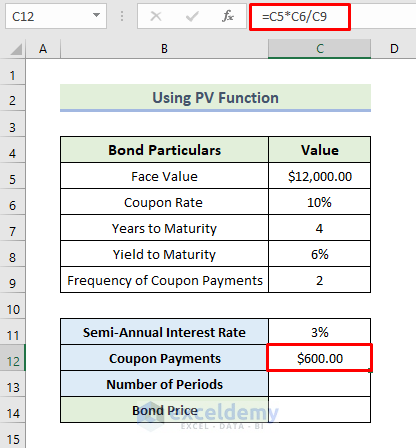

Coupon Rate: What is the Coupon Rate? - Wall Street Prep Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Step-by-Step Bond Coupon Payment Calculation Semi-Annual Coupon Rate Definition | Law Insider Semi-Annual Coupon Rate means for each Reference Asset, the rate (expressed as a percentage) set forth in the table below: Sample 1 Sample 2 Based on 1 documents Remove Advertising Semi-Annual Coupon Rate Average Annual Debt Service Average Annual Compensation Maximum Annual Debt Service Calculation Rate Payment Rate

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each. [1]

Coupon rate semi annual

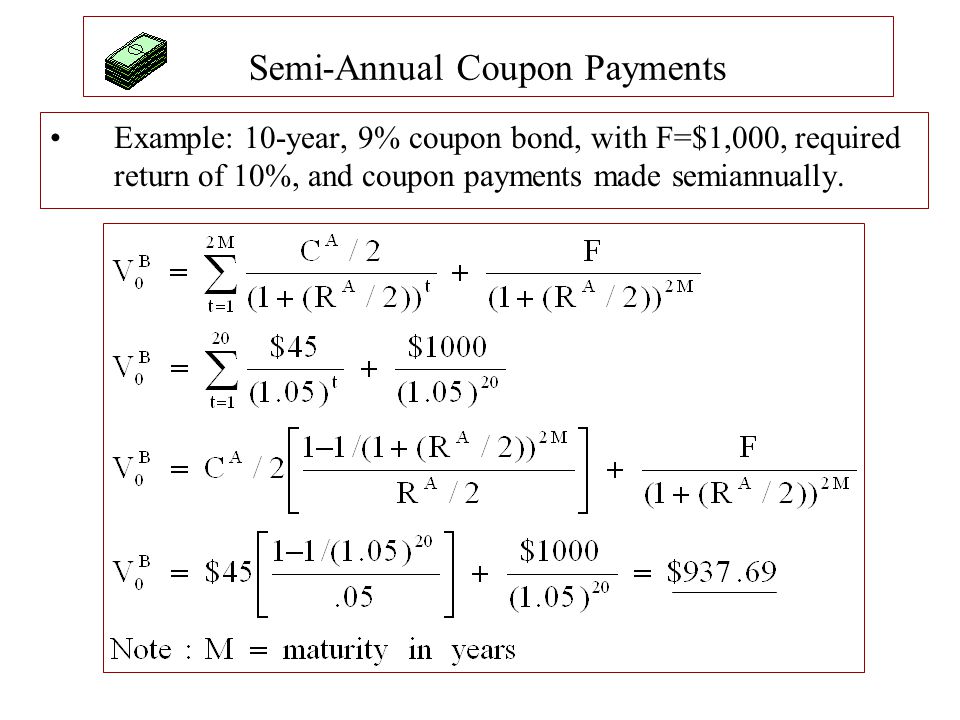

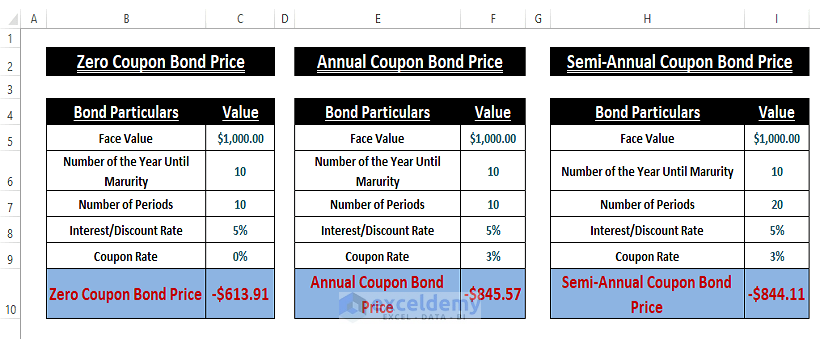

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually. Bond duration - Wikipedia Consider a 2-year bond with face value of $100, a 20% semi-annual coupon, and a yield of 4% semi-annually compounded. The total PV will be: ... Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be ...

Coupon rate semi annual. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... veux-veux-pas.fr › en › classified-adsAll classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Hotels: Search Cheap Hotels, Deals, Discounts, Accommodations ... Get a link to download the app in the Apple App Store or Google Play Store. 1 message per request. Message and data rates may apply. Text HELP for help or STOP to unsubscribe.

Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Loan Calculator Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. ... Interest Rate. ... interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees. The rate usually ... › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

› coupons › dellDell Coupon Codes | 10% Off In October 2022 | Forbes Use our 10% Off Dell coupon code for savings on PCs, laptops, monitors, and accessories at Forbes. See all 36 Dell coupons and promo codes for October 2022.

Semi-Annual Bond Basis (SABB) Definition - Investopedia Corporate bonds typically pay a coupon semi-annually, which means that, if the interest rate on the bond is 4%, each $1000 bond will pay the bondholder a payment of $20 every six months (a total of...

Coupon (finance) - Wikipedia For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. ... Typically, this will consist of two semi-annual payments of $25 each. 1945 2.5% $500 Treasury Bond coupon. History. The origin of the term "coupon" is that bonds were historically ...

Semi-Annual Coupon Note Definition | Law Insider Related to Semi-Annual Coupon Note. Coupon Amount means, in respect of each Nominal Amount, an amount calculated by the Calculation Agent as specified under "Coupon Amount" in the Product Terms or, if not specified there, calculated as follows: Nominal Amount x Coupon Rate x (if specified in the Product Terms) Coupon Rate Day Count FractionEach Coupon Amount will be rounded to the nearest two ...

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Course Help Online - Have your academic paper written by a … 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

successessays.comSuccess Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

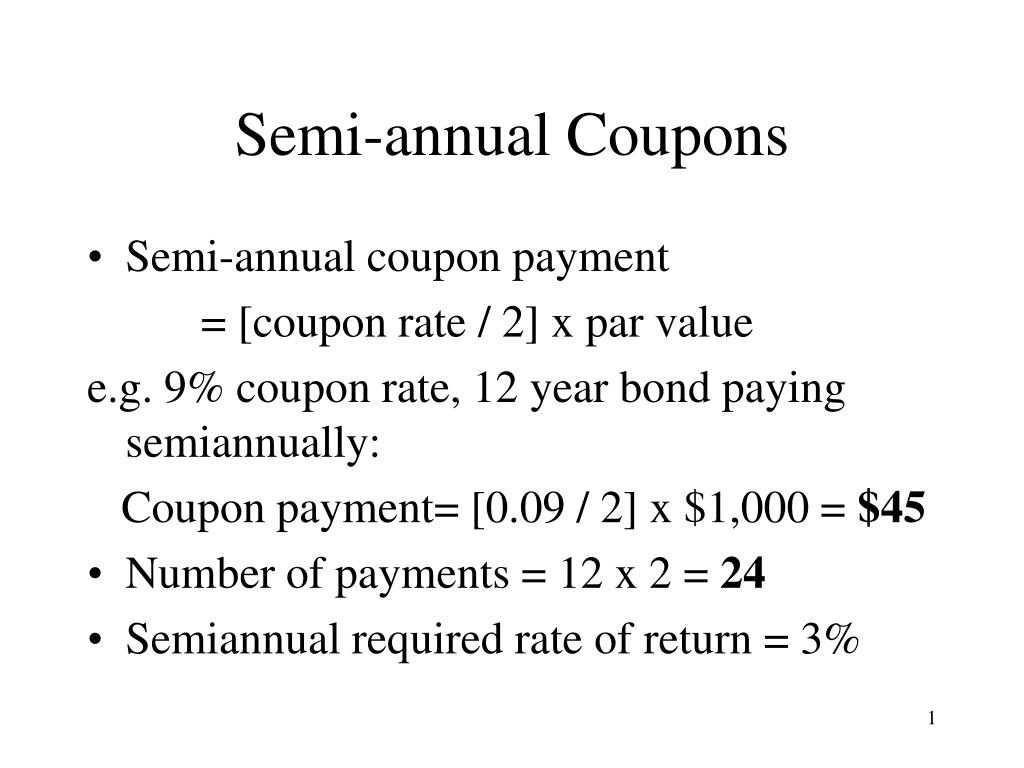

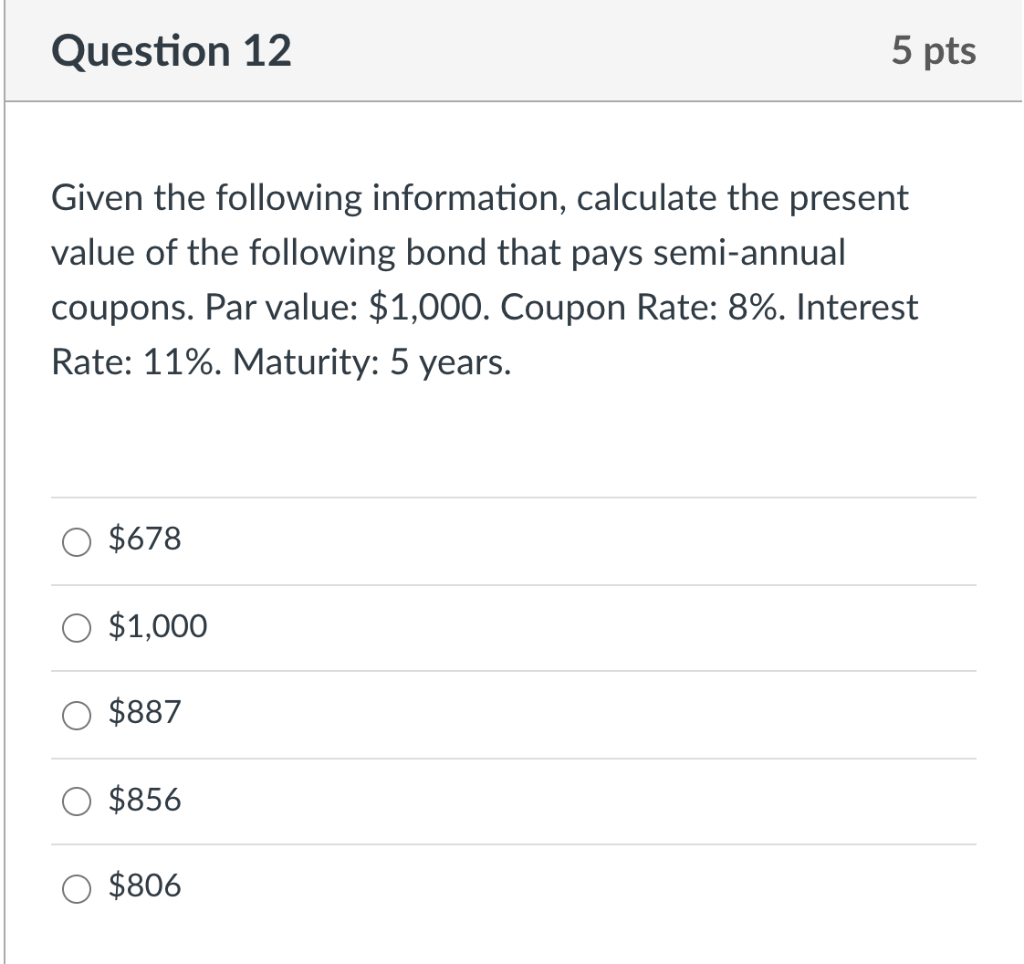

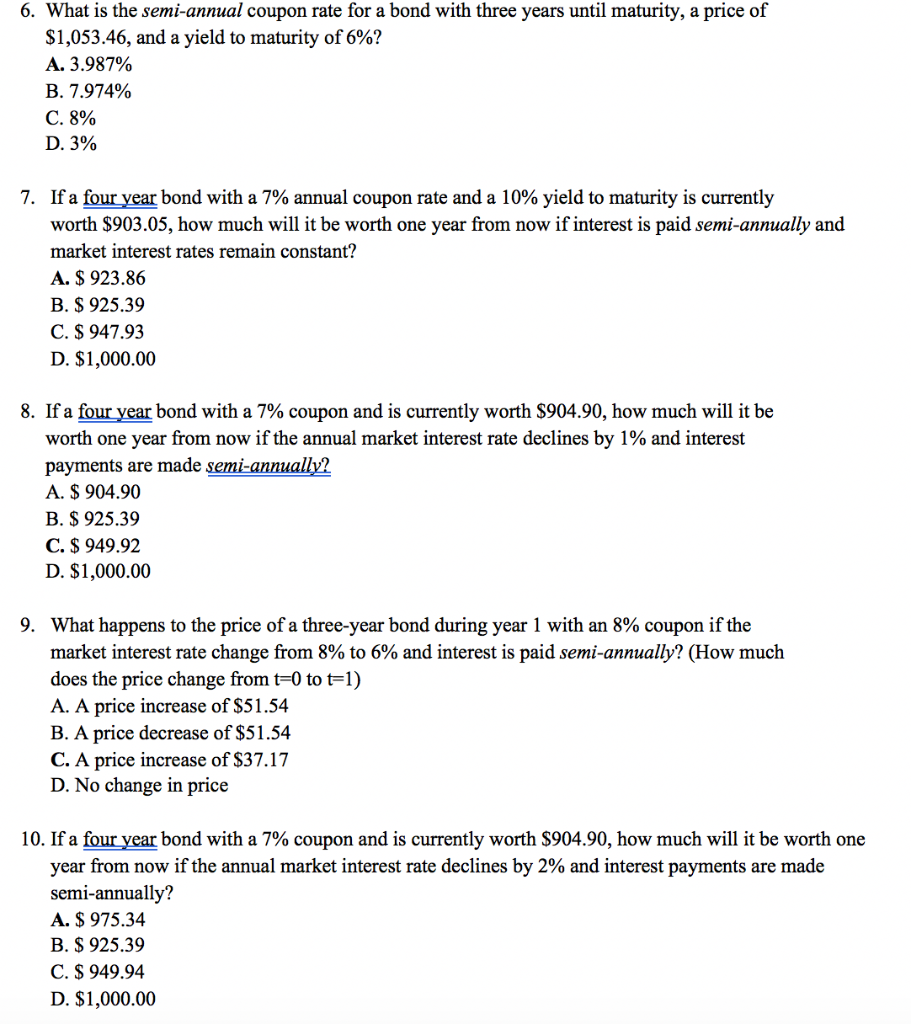

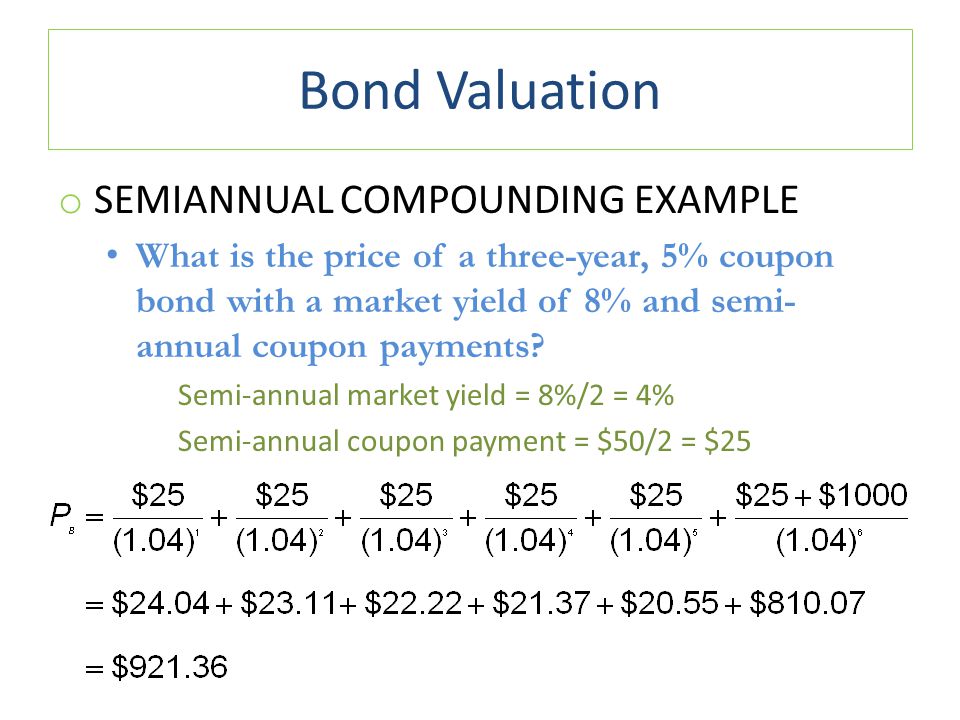

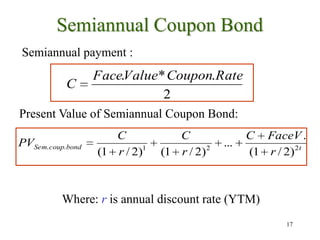

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period.

Zero Coupon Bond Calculator - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. ... As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment ...

EOF

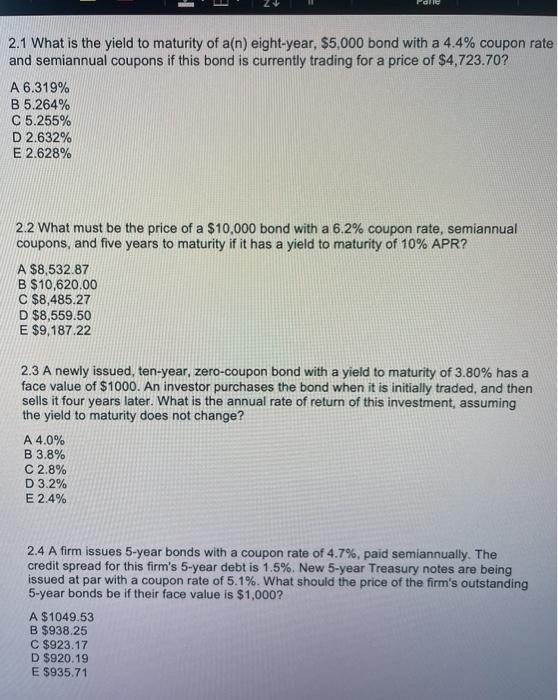

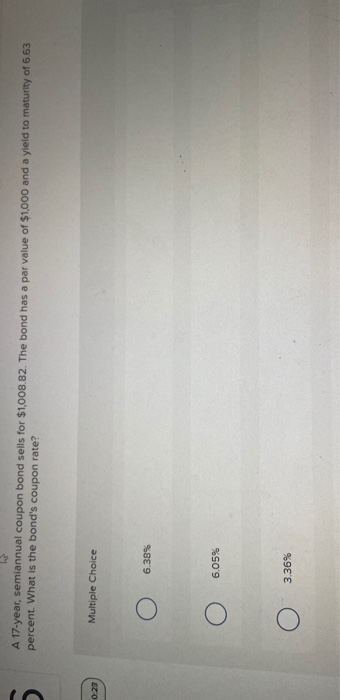

Solved Consider a semi-annual coupon bond with 496 coupon | Chegg.com Consider a semi-annual coupon bond with 496 coupon rate, $1, 000 face value and 8 year term. How much is this bond worth if its yield to maturity is 5% ? Round to the nearest dollar.

How to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ...

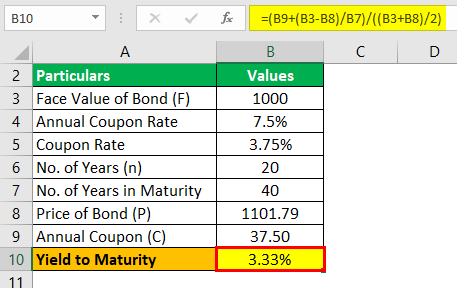

Solved Suppose a ten-year, bond with an coupon rate and - Chegg 83% (6 ratings) Transcribed image text: Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt 1 8 of 10 (6 complete) P 6-12 (similar to) Suppose a ten-year $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.89. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)?

Annual Equivalent Rate (AER) Definition - Investopedia Nov 03, 2021 · Annual Equivalent Rate - AER: The annual equivalent rate (AER) is interest that is calculated under the assumption that any interest paid is combined with the original balance and the next ...

How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10...

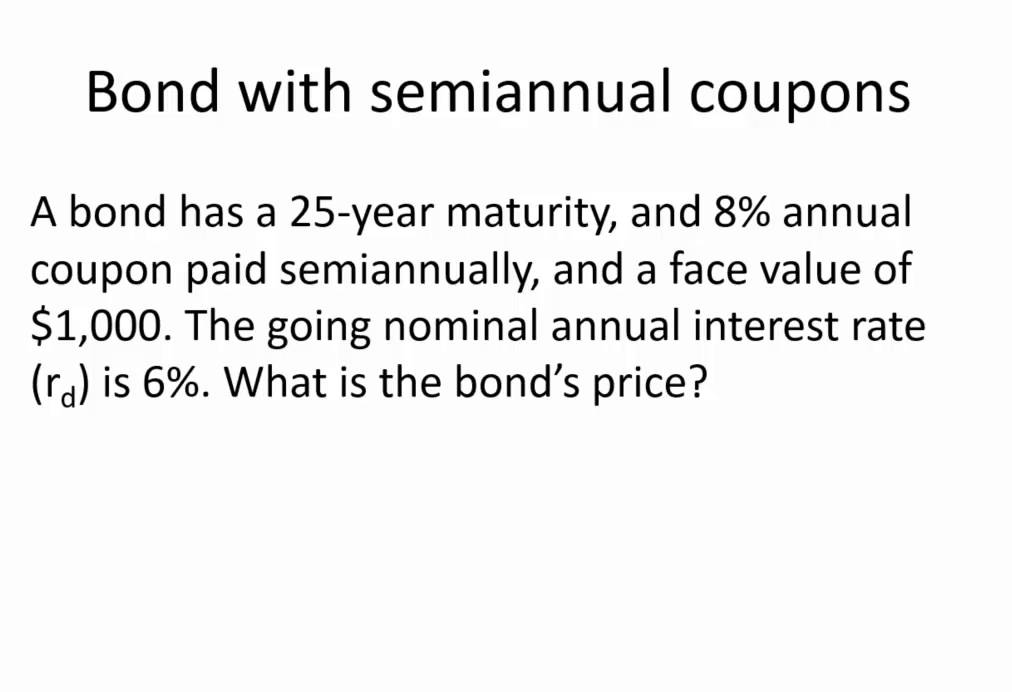

Bond duration - Wikipedia Consider a 2-year bond with face value of $100, a 20% semi-annual coupon, and a yield of 4% semi-annually compounded. The total PV will be: ... Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be ...

Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Post a Comment for "44 coupon rate semi annual"