43 irs quarterly payment coupon

Businesses | Internal Revenue Service - IRS tax forms The partners may need to pay estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. As a partner, you can pay the estimated tax by: Crediting an overpayment on your 2021 return to your 2022 estimated tax; Mailing your payment (check or money order) with a payment voucher from Form 1040-ES; Using Direct Pay; Using EFTPS: The ... Form 1040-ES: Paying Estimated Taxes - Jackson Hewitt Form 1040-ES is used to calculate and pay your quarterly estimated tax payments. This form can be manually completed and filed quarterly during the year. Form 1040-ES can be generated by tax software. Once your estimated tax payment has been calculated, the current payment voucher must be sent to the correct IRS address based on the state where ...

Estimated Tax Payments Due June 15, 2022 - News Of Oregon Estimated Tax Payments Due June 15, 2022. By. Marisa Lloyd. Published. June 10, 2022. Generally, personal income taxpayers are required to make quarterly tax payments if you expect your tax after withholding and credits (including refundable credits) to be $1,000 or more when you file your 2022 Oregon return. Details are available at Oregon ...

Irs quarterly payment coupon

Why did 1040-ES estimated tax vouchers print out? Do I need them? - Intuit We'll automatically include four quarterly 1040-ES vouchers with your printout if you didn't withhold or pay enough tax this year. We do this to head off a possible underpayment penalty on next year's taxes. You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. When Are Quarterly Taxes Due in 2022? Dates to Bookmark - Business Insider January 15, 2022, was the deadline for quarterly payments on income earned from September 1 to December 31, 2021. April 18: taxes due on earnings from January 1 - March 31, or for the full year ... 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the

Irs quarterly payment coupon. Montana Individual Income Tax Payment Voucher (Form IT) Montana Individual Income Tax Payment Voucher (Form IT) 2021: 30-12-2021 11:47: Download: Available in our TransAction Portal (TAP)?mdocs-file=55943. Contact Customer Service ... You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan. How do I make estimated tax payments? - Intuit Mail your payment along with the corresponding 1040-ES voucher to the IRS address listed on the voucher. Quarterly payment due dates are printed on each voucher. Additional estimated tax payment options, including direct debit, credit card, cash, and wire transfer, are available at the IRS Payment website. IRS Mailing Address: Where to Mail IRS Payments File Here is a clear guide on how to fill in IRS Form 1040 using PDFelement. Step 1. Import IRS Form 1040 into PDFelement You need to launch PDFelement on your device and click + to import Form 1040 for filling it out across the platform. Try It Free Step 2. Fill Out Appropriate Fields of Irs Form 1040 For those who pay estimated taxes, second quarter June 15 deadline ... IR-2022-120, June 8, 2022 WASHINGTON — The Internal Revenue Service reminds taxpayers who pay estimated taxes that the deadline to pay their second quarter tax liability is June 15. Taxes are pay-as-you-go This means taxpayers need to pay most of the tax they expect to owe during the year, as income is received. There are two ways to do that:

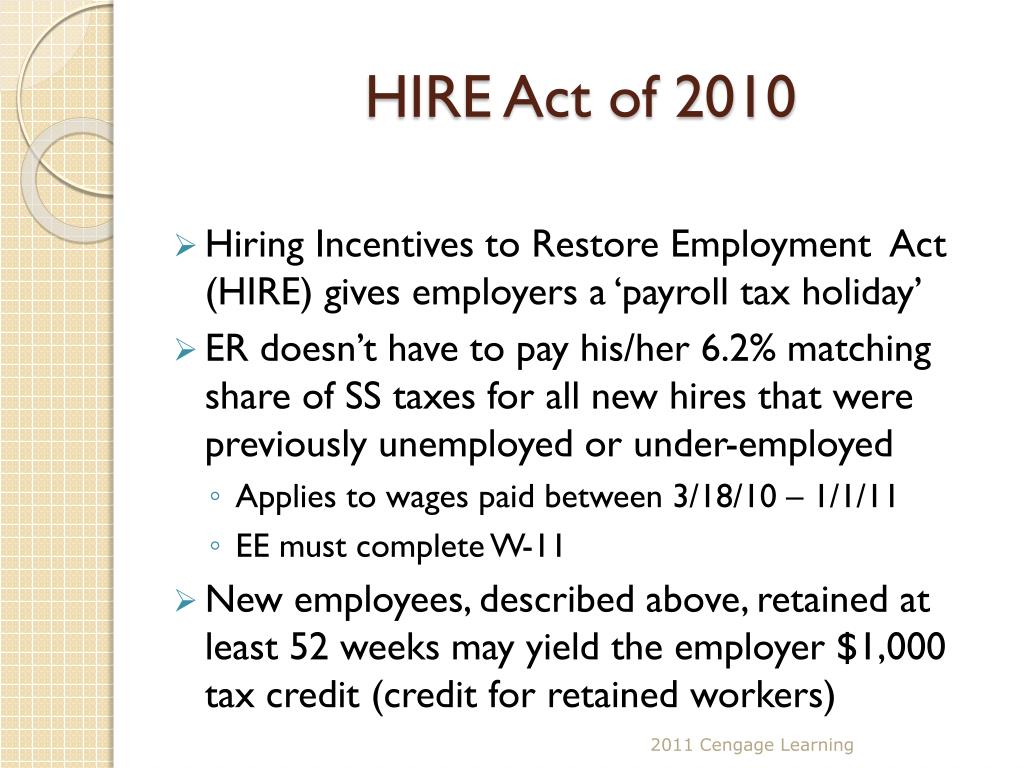

IRS Federal Tax Underpayment Penalty & Interest Rates | Intuit IRS Penalty & Interest Rates. IRS interest rates will remain unchanged for the calendar quarter beginning April 1, 2021. The rates will be: 3% for overpayments (2% in the case of a corporation); 3% for underpayments; and; 5% for large corporate underpayments. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 … ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT … Quarterly Federal Excise Tax Return Employer’s Annual Federal Tax Return for Agricultural Employees Employer’s Annual Federal Tax Return Annual Return of Withheld Federal Income Tax Return of Organization Exempt from Income Tax Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons U.S. Income Tax Return for … Drake - Federal Tax Payment Service payUSAtax enables federal taxpayers to pay their individual income taxes and business taxes with a credit card, debit card or Bill Me Later. Do I Need to Pay Estimated Taxes? An FAQ Cheat Sheet You needed to file quarterly estimated tax payments last year or your current tax return requires an additional tax payment in excess of $1,000. You receive income that does not have taxes withheld. Common sources of this type of income are Social Security Benefits, part-time jobs, and self-employment income.

Estimated Quarterly Tax Payments: How They Work & When to Pay in 2022 How to calculate quarterly estimated taxes There's more than one way. Method 1 You can estimate the amount you'll owe for the year, then send one-fourth of that to the IRS. For instance, if you... Where To Mail Quarterly Tax Payments? (Best solution) - Law info The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA. To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment. directpay.irs.gov › go2paymentIRS Direct Pay Redirect Depending on your income, your payment may be due quarterly, or as calculated on Form 1040-ES, Estimated Tax for Individuals. You do not have to indicate the month or quarter associated with each payment. If you want to make a late estimated tax payment after January 31st (for last year), select Balance Due as the reason for payment. IRS: Deadline for third quarter estimated tax payments is Sept. 15 IR-2021-177, September 7, 2021. WASHINGTON — The Internal Revenue Service reminds people that September 15, 2021, is the deadline for third quarter estimated tax payments. This generally applies to people who are self-employed and some investors, retirees and those who may not normally have taxes withheld from their paycheck by their employers.

Payments | Internal Revenue Service - IRS tax forms 28/05/2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

IRS reminder to many: Make final 2021 quarterly tax payment by Jan. 18 ... Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now, directly to the Internal Revenue Service. The deadline for making a payment for the fourth quarter of 2021 is Tuesday, January 18, 2022. Income taxes are pay-as-you-go.

Quarterly payments - Intuit Level 15. October 27, 2021 10:05 AM. You cannot pay the quarterly estimated tax payments directly through TurboTax. TurboTax has a feature where you can calculate your estimated tax payments. Those payments will be entered on a Form 1040-ES that you can print and mail to the IRS. See this TurboTax support FAQ for calculating next years ...

7 Ways To Send Payments to the IRS - The Balance There are 7 easy ways to send payments to the IRS. The IRS typically announces the date when it will begin accepting tax returns during the first week of January of each year. You can pay the IRS in several ways when the time comes: in person at various payment centers, online, or by mailing a check or money order through the U.S. Postal Service.

Failure To Deposit: IRS 941 Late Payment Penalties 10/09/2019 · Businesses file Employer's Quarterly Federal Tax Return paid after a month of each quarter. Here's what you need to know about 941 late payment penalty. Businesses file Employer's Quarterly Federal Tax Return paid after a month of each quarter. Here's what you need to know about 941 late payment penalty. Our mission is to protect the rights of …

IRS: Make Fourth- Quarter 2021 Quarterly Tax Payments by January 18 to ... The IRS has a tax withholding estimator tool, but due to a service outage it is unavailable until "late January." To make estimated tax payments, taxpayers can use IRS Direct Pay or their IRS online account to schedule payments electronically. To continue your research on individual estimated tax responsibilities, see FTC/2d FIN ¶S-5200.

› pub › irs-pdf2022 Form 1040-ES - IRS tax forms use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if paying with a debit or credit card,

help.taxreliefcenter.org › 941-late-payment-penaltyFailure To Deposit: IRS 941 Late Payment Penalties | Tax ... Sep 10, 2019 · 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice; 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty) The IRS expects deposits via electronic funds transfer.

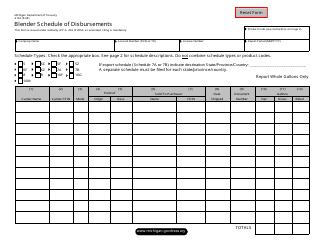

Payment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ...

Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 ...

Quarterly Estimated Tax Payments - Who Needs to pay, When And Why If you pay by credit card, the IRS will refer you to an approved payment system. There will be a fee for using this method. It can range from a flat fee of $2.59 per payment to up to 2% of the amount paid. It will add to the outlay of the estimates, so it's best to pay through your bank if you can. Form 1040-ES

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

How To Get Ahead on Tax Payments for Next Year - The Balance The IRS charges penalties if you don't do so and come up short at filing time. 1 But other taxpayers are free to pay in this way as well. To avoid an estimated tax penalty, pay at least 90% of your total tax bill by year's end if you suspect that you'll owe $1,000 or more in income tax for the year. 2. The "quarterly" part of this ...

DOR Estimated Tax Payments | Mass.gov Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. It's fast, easy, and secure. In addition, extension, return, and bill payments can also be made. Calculations. Before making an Income quarterly estimated payment, calculate online with the Quarterly Estimated Tax Calculator.

How to Pay Federal Estimated Taxes Online to the IRS in 2022 Take your net profit from Schedule C and multiply it by two numbers: 92.35% and 15.3%. The result is your self-employment tax. For example, if your net profit is $10,000, you calculate your self-employment tax as follows: $10,000 x 0.9235 x 0.153 = $1,413.

1040paytax.comDrake - Federal Tax Payment Service payUSAtax enables federal taxpayers to pay their individual income taxes and business taxes with a credit card, debit card or Bill Me Later.

download.eftps.com › PaymentInstructionBookletPayment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ...

Post a Comment for "43 irs quarterly payment coupon"