44 zero coupon bond yield calculation

T Dividend Yield 2022, Date & History (AT&T) - MarketBeat AT&T's most recent quarterly dividend payment of $0.2780 per share was made to shareholders on Monday, May 2, 2022. Bond Statistics - Monetary Authority of Singapore Bond Statistics. Get daily closing prices, historical auction data and other statistics for Singapore Government Securities (SGS) bonds. Daily SGS Prices. Historical SGS Prices and Yields - All Issues.

which of the following bonds is trading at par The next regular meeting 6/14/2022 - 6pm at the Admin Offices; Shoreland Firefighters Association Fireworks - 6/25 with rain date 6/26; Special Meeting 6/14/2022 - Records Retention- 5pm at the Admin Offices

Zero coupon bond yield calculation

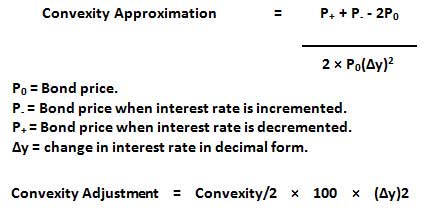

Bootstrapping | How to Construct a Zero Coupon Yield Curve in … Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Your Complete Guide to Corporate Bonds - The Motley Fool A corporate bond is a loan to a company for a predetermined period, with a predetermined interest yield it will pay. In return, the company agrees to pay interest (typically twice per year) and ... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Zero coupon bond yield calculation. What is a Coupon Value? Definition and Calculation The bond yield changes as bond prices move, a factor bond traders consider in the secondary market. Below is a zero-coupon rate example: A zero-coupon rate bond does not pay an annual coupon rate; It has longer maturity dates and greater volatility but sells for a discount; An entity sells a 20-year zero-coupon rate bond at $5,000 iShares USD Asia High Yield Bond ETF | O9P - BlackRock 04.07.2022 · The iShares USD Asia High Yield Bond ETF seeks to track the investment results of an index composed of USD-denominated high yield bonds issued by Asian governments ... Scientific consensus suggests that reducing emissions until they reach net zero around mid-century (2050 ... only corporate issuers are covered within the calculation. Bond Convexity | Convexity Formula, Properties & Examples - Video ... Calculate the duration and convexity of a 4-year, 4 percent coupon bond with a face value of $1,000. Assume that the yield on this bond is 5 percent. If the interest rates decrease 10 basis points, wh U.S. Treasury Bond Overview - CME Group U.S. Treasury Bond Yield Curve Analytics ... View Yield calculation methodology ... Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. ...

Fixed Income Corporate Bond Indices - NSE India NSE India (National Stock Exchange) - LIVE stock/share market updates from one of the leading stock exchange. Current stock/share market news, real-time information to investors on NSE SENSEX, Nifty, stock quotes, indices, derivatives. › EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ... What is a Coupon? Definition and Calculation Coupon payment calculation example: Assume an entity issues a $500 bond with a coupon rate of 2.00%; The annual coupon payment is $10. The coupon payment formula is: ... Investors who reinvest the semi-annual coupon payments into the bond will achieve a higher effective yield; Zero-coupon bonds do not pay interest but reward investors with a ... United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.097% yield.. 10 Years vs 2 Years bond spread is 34.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.05 and implied probability of default is 0 ...

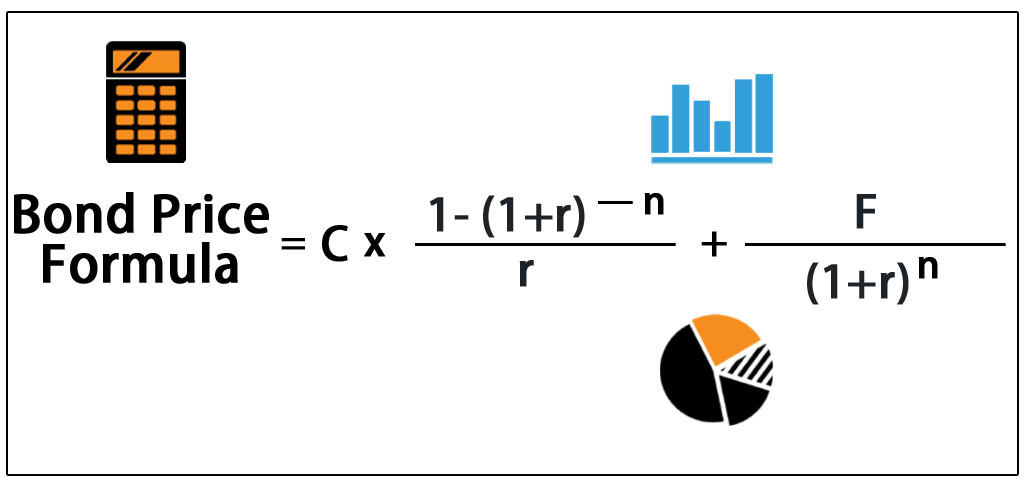

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Solve nine problems addressing a range of issues related to valuation ... Some bonds are sold at a deep discount and do not provide any coupon interest payments; these are called zero-coupon bonds. Previously we have talked about the fact that the value of any financial asset should be based on the present value of its future cash flows. This holds true for the valuation of bonds as well. [100% Off] Fixed Income Securities: Become A Bond Analyst &Amp; Investor Description. Investing in bonds has a lot of financial benefits for investors. It provides a regular stream of income and widens their investment portfolio. Bonds also carry low market volatility. It is a safe investment plan which allows investors to preserve and increase their capital. Investing in top-quality government bonds doesn't come ... T2023-S$ Temasek Bond The bond calculator is strictly for the T2023-S$ Temasek Bond listed on the Singapore Exchange (SGX:TEKB) ... Current yield: relating annual coupon of the bond to its market price. Footnotes: 1 Actual coupon payments will vary depending on number of days in each coupon payment period. See "How is the half yearly interest rate calculated ...

Factsheet | CS 9.750% Perpetual Corp (USD) Credit Suisse Group AG operates as a wealth management firm. The Company specializes in investment banking and offers wealth management activities aiming to capitalize on both the large pool of wealth within mature markets, as well as the significant growth in wealth in Asia Pacific and other emerging markets. Credit Suisse Group serves customers worldwide.

About Corporate Bonds - NSE - National Stock Exchange India Current yield. The current yield is the annual return on the amount paid for a bond, regardless of its maturity. If you buy a bond at par, the current yield equals its stated interest rate. Thus, the current yield on a par-value bond paying 6% is 6%. Yield to maturity. It tells the total return you will receive if you hold a bond until maturity.

Credit default swap - Wikipedia A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to ...

Bond Yield Definition - Investopedia 01.01.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Post a Comment for "44 zero coupon bond yield calculation"